Written by: Jess Lin

Contributor: Anderson Wu And Judy Wang

Yield farming is something widely discussed in decentralized finance. It is another way to earn money or rewards in the crypto world aside from buying cryptocurrency and NFTs. In a volatile market like we have today, a high annual percentage yield (APY) is definitely some extra padding a lot of people can use.

So, let’s talk more about yield farming and what it can do.

Table of Contents

- What is Yield Farming in Crypto?

Crypto Yield Farming

To put it simply, yield farming is many investors coming together, pooling their digital assets to earn interest through lending. It is a pretty risky strategy, but one that could produce high rewards.

Let’s take PancakeSwap, a yield farm as an example.

There are yield farms available on the platform that have interest rates between 2 to 200% APY. Users would make returns via transaction fees, liquidity pools and lending interests. As with any type of investment, there are risks and it is possible to lose everything, and it’s important for yield farmers to be aware of this.

Want to know more about crypto yield farming? There are other resources available on platforms such as Coindesk, DeFipulse, Aave, and Uniswap, which also offer yield farming.

Yield Farming Breakdown – How It Works

How does yield farming work? It’s actually pretty easy to grasp. If you have a savings account with a bank and understand what the bank is doing with that money, then you already have an idea about yield farming.

When you put money into your savings account, you can earn an interest rate on it when the bank lends it out in the form of a loan. Liquidity pools work very much the same way. However, what the cryptocurrency yield farmers put into the liquidity pool is placed in smart contracts.

Depending on the rules, some liquidity pools may require you to stake your cryptocurrency for a set time limit. It all depends on what you choose to participate in. It is usually a high-risk high reward deal.

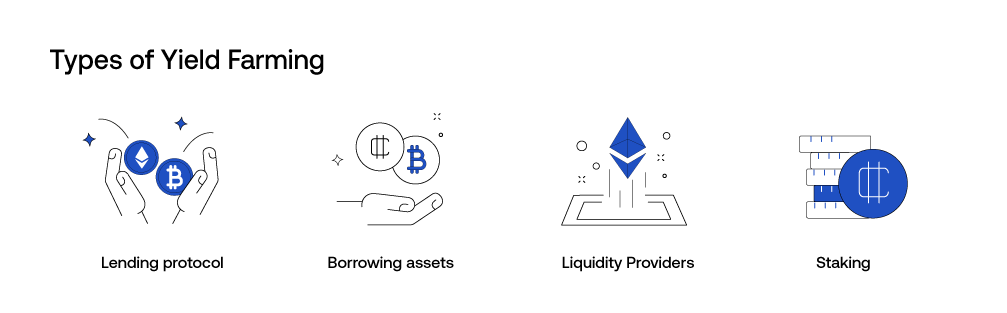

Types of Yield Farming

Let’s look at the various types of yield farming.

Lending protocol

Lending crypto assets to the borrowers is facilitated through smart contract applications. Lenders would earn rewards from the interest rate.

Borrowing assets

Investors can choose to use one type of coin as collateral to borrow another. The benefit of borrowing is that investors can hold on to their initial collateral and potentially have its value go up while also farming yield on the borrowed coins.

Liquidity Providers

Users stake their assets in liquidity pools and earn a return on transaction fees. On DeFi platforms, users can also expect to reap exchange fees, farming rewards and incentivized trading.

Farming rewards give users the platform’s native token in exchange for providing liquidity. Incentivized trading sees the DeFi platform offer rewards for users who trade a certain pair of tokens.

Staking

Staking generally takes place on proof-of-stake (POS) blockchains where users would earn an incentive for staking their crypto on the blockchain to provide security.

The Risks of Yield Farming

Yield farming strategy is pretty high risk, and many yield farmers utilize various strategies to gain the most results. Traditionally, an APY of anything above 3% is considered amazing, but crypto yield farming has the potential to exceed that.

How can yield farming promise such high returns? The reasons are:

- Liquidity mining – Users not only receiving interest but a new token as well as incentive

- Risk – High-risk high reward concept

- Leverage – The borrowing protocol we covered above

We mentioned a couple of times before, that high-risk can mean high rewards, but conversely, it could also mean great losses. The risks that come with yield farming include:

- Liquidation risk

There is a chance that your collateral could be liquidized if payment obligations are not met for investors. Liquidation risk can also happen when the price of a token in a pool decreases significantly, which can result in impermanent loss.

Another situation that could result in liquidation risk is during borrowing. The value of the collateral may go down, which would require liquidation to pay off debts.

There is also the risk of over-collateralization. Some pools may ask users to pay more collateral than what they are borrowing and if the collateral’s value drops significantly, liquidation will also happen.

- Smart contract risk

Although it is rare, smart contracts are susceptible to certain risks such as smart contract bugs, or issues with the system.

- Decentralized Finance (DeFi) specific risk (aka system risk)

There could also be cyber attacks aimed specifically at DeFi platforms that attack a liquidity pool or liquidity providers and drain their assets.

Protocols for yield farming depend on the users for liquidity. If there isn’t enough liquidity in a pool, there won’t be enough funds to pay users when they pull their investments, which could result in losses and price decreases.

From a system risk standpoint, a big problem on some platforms is centralized governance. When power is held by a central authority, possible risks that come with that could include mismanagement and corruption.

To understand the pricing of assets and returns for yield farming, the protocols rely on something called “oracles”. Oracles are external price feeds that could be wrong or even manipulated, which would affect the returns.

FAQ

Is yield farming profitable?

Yes, yield farming is profitable, but it’s also high-risk. It’s up to the investor to determine if the risk is worth the return. Although it can indeed be profitable, there is a chance for great losses as well.

What is yield farming vs. staking?

Yield farming looks to gain the highest returns while staking aims to secure a blockchain through investor support.

How do I start yield farming?

You can start by depositing assets into a liquidity pool on yield farming platforms such as Coindesk, DeFipulse, Aave, and Uniswap.

Conclusion

The potential returns of yield farming can be very attractive, especially in a time when traditional markets are tanking. However, is it worth the risk? It’s really up to the investor. Doing due diligence and educating yourself on the crypto markets and investment climate can help you make an informed decision. It’s also important to keep the potential risks in mind.

Related Articles:

- How to Choose an NFT Marketplace for You

- How an EVM-Compatible Cold Wallet Can Make Your Life Easier

- Coinbase Launches Blockchain – Base

Sources:

- https://www.thebalancemoney.com/what-is-yield-farming-in-cryptocurrency-5272063

- https://blockworks.co/news/what-is-yield-farming-what-you-need-to-know

- https://www.financemagnates.com/cryptocurrency/education-centre/everything-you-need-to-know-about-crypto-yield-farming/amp/

- https://www.businessinsider.com/personal-finance/yield-farming?amp

- https://www.coindesk.com/learn/what-is-yield-farming-the-rocket-fuel-of-defi-explained/

0 comments