Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice.

Hackers are the ultimate enemy and hindrance to more trust in web3 and the crypto community. As we live in an increasingly digital age, most of our daily transactions move online – whether we like it or not. All types of shopping, bill paying, and entertainment are done online, but how do we ensure our sensitive info is safe?

We can try to use VPNs, anti-viruses, etc., but in the world of cryptocurrency, we need to rely on other forms of security to keep our assets safe. Before we can address the issue, we need to figure out where it all goes wrong, and when and where hackers can access our private information.

Table Of Contents

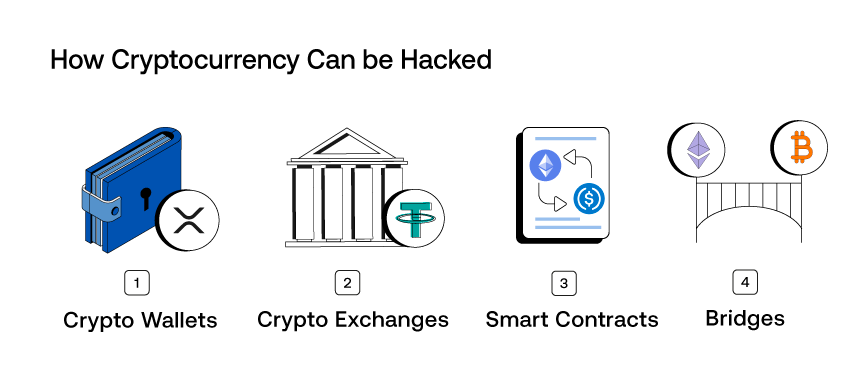

How Cryptocurrency Can be Hacked

There are a few ways as to how wily hackers can get the best of us. However, if we identify these weak areas beforehand (as we will now), we can hopefully stop the ill-intentioned dead in their tracks. So, where are hacks most likely to happen?

Crypto Wallets

Crypto wallets are essential tools for managing and securing your digital assets. However, they are not immune to attacks. There are two distinctive types of crypto wallets: custodial and non-custodial. Custodial wallets are provided by third-party service providers like exchanges, while non-custodial wallets offer more control and privacy to the user.

One common vulnerability with a crypto wallet is the theft of private keys. Private keys are like the passwords to your crypto assets. If someone gains access to your private keys, they can empty your wallet. This can happen if you store your private keys online, on devices connected to the internet, or if you reveal them to others who take advantage of it.

To mitigate this risk, it’s advisable to use hardware wallets, which are offline devices specifically designed to store your private keys securely. Hardware wallets are much harder to hack compared to software or online wallets.

Another potential threat is the exposure of personal information associated with your wallet. If attackers obtain your personal information through phishing or other types of scams, they can target your crypto wallet and assets. Never share your personal details or private keys with anyone.

Crypto Exchanges

Crypto exchanges act as intermediaries where users can buy, sell, or trade crypto. While these platforms have brought significant convenience to the crypto world, they are also frequent targets for cyberattacks. The security of crypto exchanges is directly correlated to the safety of your crypto assets.

One of the major risks associated with exchanges is the division between hot wallets and cold wallets. Hot wallets are connected to the internet, making them more susceptible to hacks. On the other hand, cold wallets, like the ones we offer at SecuX, are offline storage solutions that provide better security. To enhance the safety of your assets, it’s advisable to move your holdings to your own crypto wallet when not actively trading on an exchange.

Crypto exchanges often hold a vast amount of assets, making them appealing targets for cybercriminals. This could result in numerous high-profile crypto hacks. To reduce this risk, you should choose exchanges with a strong security track record and consider using two-factor authentication and other security measures.

Smart Contracts

While smart contracts are designed to be trustless and automated, they can still be vulnerable to exploitation. They are like digital agreements where all the rules are written in code and automatically enforced when terms are met.

One common issue is the improper coding of smart contracts, which can lead to vulnerabilities. Hackers may exploit these vulnerabilities to drain funds from the contract. Auditing and testing smart contracts for security flaws are essential to prevent such incidents.

While smart contracts offer a transparent and tamper-proof way to execute agreements, they are not immune to security risks. Careful coding, auditing, and management of the crypto wallets used to access these contracts are important to minimize potential vulnerabilities and protect your crypto assets within smart contracts.

Bridges

Blockchain bridges are tools that facilitate interoperability between different blockchain networks, enabling the transfer of assets between them. Unfortunately, these bridges can be points of vulnerability in the crypto ecosystem.

One significant risk associated with blockchain bridges is a weakness in the code. If attackers find weaknesses, they can manipulate the bridge to compromise the security of assets being transferred. This can result in the loss of crypto assets.

When using bridges, it’s crucial to ensure that the platforms and technologies involved are reputable and verified. As with other aspects of the crypto space, using non-custodial wallets or hardware wallets is recommended to enhance the security of your assets during cross-chain transfers.

We would also recommend staying informed about the security measures in place for the specific bridge you are using and be cautious of potential phishing attacks or scams.

Secure Your Crypto

That was a lot of info on what to look out for and what to do to give your crypto wallet the best chance. To make sure you keep on top of things, we’ve summarized all our crypto security tips.

- Use Non-Custodial Wallets: Opt for non-custodial wallets, which give you full control over your private keys. Unlike custodial wallets provided by third parties, these wallets minimize the risk of hacks because the control is within your hands.

- Consider Hardware Wallets: Hardware wallets are physical devices designed to store your private keys offline. They offer robust security, making it challenging for hackers to access your assets. We’ve got a pretty good lineup here.

- Back-up Your Keys: Make sure to securely back up your wallet’s private keys or recovery phrases. Store these backups in separate, secure locations.

- Enable Two-Factor Authentication (2FA): Enable 2FA wherever possible. This adds an additional layer of security by requiring a second form of verification.

- Stay Informed: Keep yourself updated about the latest security threats and best practices.

- Beware of Phishing Scams: Be cautious of unsolicited messages, emails, or links. Phishing attempts often impersonate trusted sources to trick you into revealing sensitive information. Do your own research and always verify the authenticity of any communication before taking action.

- Use Reputable Exchanges: When trading on cryptocurrency exchanges, choose well-established platforms with strong security measures.

- Diversify Your Assets: Avoid putting all your crypto assets in one place. Spread your investments across multiple wallets and platforms.

- Regularly Update Software: Ensure that your wallet software, operating systems, and security tools are up to date. Updates often include crucial security patches.

- Practice Caution with Third-Party Apps: Be careful when using third-party apps or services related to crypto. Only use apps from trusted sources and review permissions before granting access.

Conclusion

Security in web3 extends beyond your regular hardware wallet. People can still get hacked if they don’t take the proper precautions to keep their private keys safe. Never share your private info online or give your seed phrase to unidentified sources. Following our crypto security best practices can ensure your assets remain safe.

Related Articles

Most Common Web3 Scams and How to Avoid Them

Air-Gapped Wallets – Are They the Safest?

Symmetric VS Asymmetric Encryption in Cryptography

0 comments