Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice.

We see the emergence of two prominent roles when it comes to financial markets – market makers and market takers. The two roles differ in their strategies and objectives, which can shape the market. Without giving too much away, a market maker would create seamless transactions and a market taker would seize opportunities. Let’s dive into the dynamics of how markets operate to really understand the role of the market maker and taker.

Table of Contents

- Basic Market Dynamics

- What is a Market Maker?

- The Definition of Market Takers

- The Differences Between Market Makers and Market Takers

- Choosing a Role

- Conclusion

Basic Market Dynamics

Market dynamics reflect the ebb and flow of financial exchanges, showing relationships between buyers and sellers. A market is a dynamic ecosystem where assets change hands through buying, selling and trading.

Buyers seek value, and sellers aim to capitalize on their assets. The equilibrium is maintained through supply and demand, while shaping prices in real-time. It’s important for investors and traders alike to understand this, as it forms the basis for analyzing trends, making informed decisions, and navigating the complexities of financial markets.

What is a Market Maker?

Market makers are crucial participants in crypto financial markets, acting as go-betweens (intermediaries) for buyers and sellers. Their main job is to make transactions on trading platforms smoother by always stating prices at which they’re willing to buy or sell securities.

This helps create a lively trading atmosphere. When they quote the highest price they’re willing to pay (bid) and the lowest price they’re willing to accept (ask), the difference is called the bid-ask spread. This spread is vital because it affects the ease and cost of trading—smaller spreads usually mean lower costs and more accessible trading for investors.

Market makers make trading easier. Smaller spreads also mean it’s easier and cheaper for traders to make deals quickly. By doing this, market makers keep the market active and prices steady.

The Definition of Market Takers

But what about market takers? As you have probably guessed, they’re the opposite of what a market maker is.

Market takers are those in financial markets who act on existing prices rather than setting them. Unlike market makers, they don’t provide quotes but instead execute trades based on current market conditions. Their approach involves taking advantage of opportunities rather than creating market liquidity. In regards to the crypto industry, automated market maker (AMM) systems are used.

Market takers act quickly and swiftly, placing market orders to buy or sell at the best available prices. This proactive position distinguishes them from market makers, who play a more passive role by providing market liquidity through continuous quoting.

Market takers navigate the market currents, responding to the dynamic pricing conditions and swiftly seizing opportunities as they come.

The Differences Between Market Makers and Market Takers

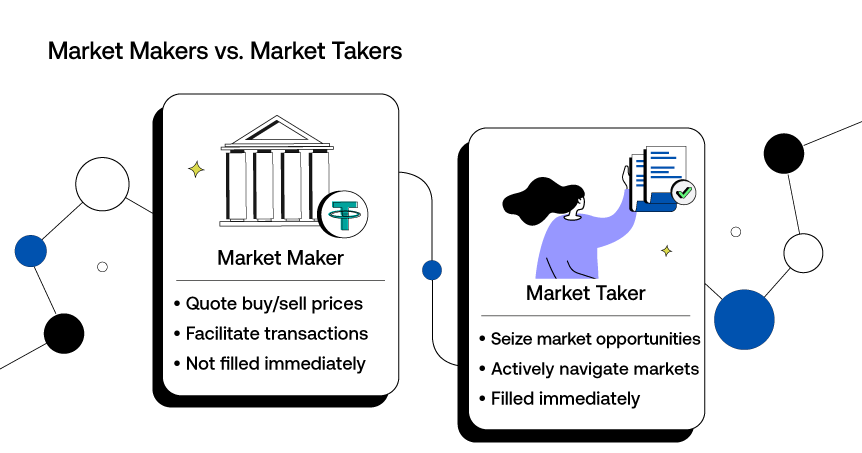

Let’s sum up the differences between the two roles. Market makers and market takers differ fundamentally in both their roles and strategies in the market.

Market makers, such as financial institutions, are liquidity providers by continuously quoting buying and selling prices. Market making aims to facilitate smooth transactions and reduce bid-ask spreads. On the other hand, market takers, often individual traders, seize existing market opportunities by executing trades at those prices.

While market makers contribute to market stability, market takers actively navigate the markets, responding promptly to current conditions.

Choosing a Role

In the realm of crypto trading, the choice between roles, such as being a market maker or engaging with existing prices as a market taker, demands careful consideration. Automated market makers leverage algorithms to continuously quote buying and selling prices, providing liquidity to the crypto market.

On the flip side, market takers in the crypto space aim to sell assets at the current market price, seizing opportunities and reacting to market conditions. While market takers may face trading fees, they benefit from the immediate execution of transactions in the crypto space.

Choosing between these roles involves weighing the benefits and challenges specific to the crypto landscape. AMMs contribute to crypto market stability, reduce bid-ask spreads, and minimize price discrepancies. On the other hand, market takers in crypto leverage flexibility and responsiveness to swiftly capitalize on market opportunities.

Factors like risk tolerance, crypto trading goals, and the desire for active or passive engagement will influence a person’s decision on which role to take. Some crypto traders may prefer the stability of AMM roles, while others appreciate the dynamic nature of market taking. Ultimately, successful crypto traders align their chosen role with their preferences.

Conclusion

The roles of market makers and market takers play fundamental roles in shaping trading dynamics. Market makers, whether in traditional or crypto markets, provide liquidity and contribute to market stability by continuously quoting buying and selling prices. On the other hand, market takers seize opportunities by conducting trades at existing market prices, adapting swiftly to ever-changing conditions.

Related Articles

Best Crypto Exchanges for SecuX Wallets

Digital Signatures – What They Are and What They Do

Sources

https://www.cmegroup.com/education/courses/trading-and-analysis/market-makers-vs-market-takers.html

https://komodoplatform.com/en/academy/market-makers-vs-market-takers/

https://cointelegraph.com/learn/market-makers-vs-market-takers-differences

0 comments