Bitcoin halving is a concept that will have quite an effect on the cryptocurrency world. It’s a unique idea that will hold profound implications for the digital asset. It will disrupt, reshape and influence web3. What is this novel idea and what exactly will it bring to the crypto landscape? We’ll start at the beginning, explaining the fundamentals of this concept, what it aims to do, and how it works.

Bitcoin Halving – What Is It?

Bitcoin operates on the proof-of-work (PoW) network consensus, which means miners (people who verify transactions) have to put in work to add blocks to the Bitcoin blockchain. They use computing power to solve complex mathematical problems to do this. PoW networks require a lot of processing power, so in return for their efforts, miners are rewarded with block rewards, which are Bitcoins.

Bitcoin halving is essentially the process of cutting a block reward by half. Don’t worry, Bitcoin miners are not having their efforts decreased by half for all rewards. Bitcoin halvings happen approximately every 4 years, or more accurately, every 210,000 blocks.

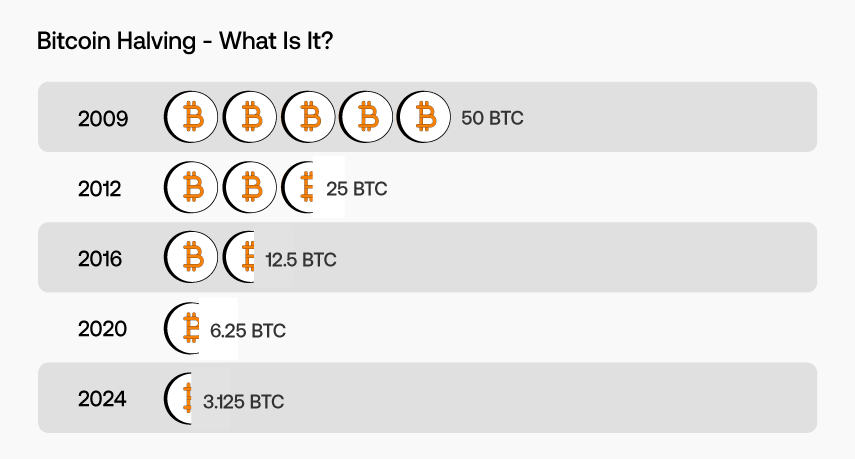

Back during Bitcoin’s birth year in 2009, miners were rewarded with 50 Bitcoins (if only that were true now). 14 years later in 2023 at the time of writing, the reward currently stands at 6.26 BTC.

Why Does Bitcoin Halving Exist?

Okay, so we all wish we’d still get 50 BTC for our work, and it looks like Bitcoin halving is something that takes away earnings, so why does it exist? Let’s take it back to when it was created.

Bitcoin halving was devised by Satoshi Nakamoto, Bitcoin’s creator in an effort to combat inflation. The digital currency has a supply limited supply, 21 million Bitcoins to be exact. By reducing the rate at which new coins are generated, Bitcoin halving makes sure that Bitcoin’s supply will reach its limit at a slower rate.

Here are some of the main reasons for Bitcoin halving in more detail:

- Inflation control – In terms of traditional currency (fiat currency), the value can suffer if centralized authorities (central banks) decide to print more money. This means there is a relatively endless supply of money. Bitcoin doesn’t operate the same way and has a cap of 21 million. By halving the rate of Bitcoin creation around every four years, the currency’s supply will inflate at a slower rate, allowing it to reach its cap in a more predictable way.

- Scarcity for increased value – Scarcity can make something more valuable – this is not a new concept for many. In fact, it’s an essential principle in economics. The halving event will decrease the supply of new coins entering the market, which will also pump Bitcoin’s price.

- Sustainability – Because the block reward is reduced, there is more incentive for miners to increase the efficiency of their operations.

- Rewards vs transaction fees – Since block rewards are decreased, the transaction fees become a more significant portion of the miners’ income. This ensures miners remain incentivized to keep the network secure, even after the last Bitcoin has been mined.

All in all, Bitcoin halving is a critical event that supports the long-term sustainability and economic viability of Bitcoin.

How Does Bitcoin Halving Work?

Bitcoin halving is an automatic event that is built into the Bitcoin network itself. Here is a step-by-step breakdown:

- Mining: Bitcoin mining involves using powerful computers to solve complex mathematical problems. These problems are necessary for validating Bitcoin transactions and adding them to the blockchain.

- Block Rewards: For every block of transactions that a miner adds to the blockchain, they receive a certain number of Bitcoins, also known as block rewards.

- Countdown to Halving: The Bitcoin protocol is designed to halve the block reward after every 210,000 blocks (approximately every 4 years).

- The Halving: Once the 210,000th block is mined, the halving happens automatically. The block reward is cut in half instantly.

- Continued Mining: After the halving, miners continue to verify transactions and add new blocks to the blockchain, but they now receive only half the Bitcoins as rewards.

- Next Bitcoin Halving: The countdown then begins again, and the process repeats until the block reward becomes so small that it reaches zero, which is projected to happen around the year 2140.

Bitcoin Halving Timeline

The first Bitcoin halving occurred in 2012 when rewards of 50 BTC were reduced to 25 BTC per block. As of 2023, the next halving will occur next year in 2024, when mining rewards go from 6.25 to 3.125 BTC. This process will occur until the last Bitcoin halving, roughly in the year 2140.

FAQ

Does Bitcoin halving impact the cryptocurrency market?

Yes, Bitcoin halving will impact the crypto market. The reduced supply of new Bitcoins can increase price volatility. Since Bitcoin has a dominant market position, the halving can influence the value and dynamics of other cryptocurrencies as well.

What happens when Bitcoin block rewards become 0?

Once Bitcoin rewards drop to zero, miners will receive transaction fees for compensation. This is a necessary shift to ensure that miners remain incentivized to validate transactions to maintain Bitcoin’s network security and integrity.

Conclusion

As the first cryptocurrency in the world, Bitcoin lives up to the expectations as a pioneer and leader in web3 infrastructure. Bitcoin halving is one such example of it influences the crypto landscape, maintains incentives, controls inflation, and maintains the blockchain’s sustainability for longer. The halvings will also affect the dynamics of the web3 space. It’s important for those involved in crypto to understand the necessity for future halving events.

Related Articles

Crypto Market Capitalization – A Useful Valuation Metric?

What are Permissioned Blockchains – An Intro to Blockchain Basics

SecuX wallets now support MetaMask and Bitcoin!

Sources

https://www.forbes.com/advisor/au/investing/cryptocurrency/bitcoin-halving/

https://www.coindesk.com/business/2023/06/07/bitcoin-halving-is-coming-and-only-the-most-efficient-miners-will-survive/

https://www.benzinga.com/markets/cryptocurrency/23/06/32714451/bitcoins-2024-halving-set-to-surge-production-costs-injecting-investor-confidence-jpmorgan

https://bitcoinmagazine.com/markets/how-halvings-will-bring-the-bitcoin-price-to-400000

0 comments