Contract law and contractual agreements have existed for hundreds if not thousands of years. Traditionally, a contract may need to be enforced by a third party in case participants do not live up to the agreements or have a dispute. Good lawyers, money, and subjectivity could sway the outcome of the verdict.

Smart contracts are revolutionary because they put everyone on the same playing field regardless of background and financial capabilities. Plus, they do it all themselves. What do we mean? Let’s find out.

Table of Contents

- Smart Contracts Explained

What is a Smart Contract?

Smart contracts are computer programs written in different programming languages (mainly Solidity) on a blockchain network such as Ethereum. It’s a digital agreement that self-executes when outlined terms are met. There is no need for an intermediary and the code written within the contract cannot be altered. Contract execution is fast, automatic, and convenient.

Smart contracts really live up to the “smart” in their name because they do not need to be enforced and execute the terms themselves. Not only that, but they are a reliable and neutral method to enter into a transaction with someone you have never met, providing a layer of trust.

How Smart Contracts Work?

The idea of smart contracts is not entirely new, but it was not until the conception of Bitcoin in 2009 that the concept was really explored. However, it was the Ethereum blockchain that really adopted smart contracts and made them a standard component of their blockchain technology.

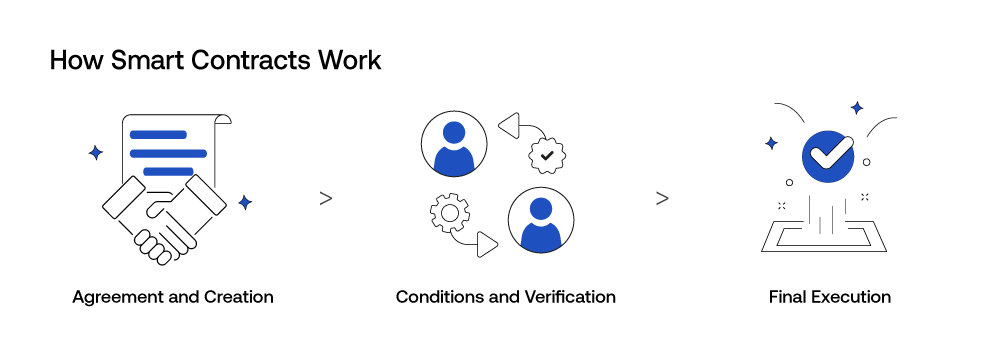

Smart contracts work in a few steps:

Agreement and Creation – The two parties that intend to enter into the agreement will first discuss the terms. Once they reach an accordance, the outlined terms are translated into smart contract code and the contract is created using the appropriate programming language.

Once that’s done, the smart contract is deployed on the relevant blockchain where the transaction is taking place.

Conditions and Verification – The conditions in the contract are created by stating “if A then B”. For example, “if the payment is transferred from party A to party B, then party B will transfer ownership of the asset to party A”.

When the conditions are carried out, the blockchain will validate and verify them before executing the contract. Because of decentralization, blockchains will utilize multiple nodes to reach a consensus on the smart contract before execution.

Final Execution – Once everything is verified, the smart contract terms are carried out.

SecuX, a leader in secure crypto hardware wallets, provides a powerful way to interact with blockchain networks and smart contracts through their latest wallet models such as the V20, W20, Shield BIO, and the newly launched Neo Series. These wallets, equipped with advanced security features, allow users to safely participate in decentralized finance (DeFi), real estate transactions, and other applications using smart contracts. The integration of these wallets with decentralized applications (dApps) enhances the user experience by providing seamless and secure access.

Let’s take a look at a real-world example of smart contracts in action.

We will use a simplified case of purchasing NFTs as an example. Say an NFT project wants to fundraise for a charitable cause by selling NFTs. Each NFT is set in cryptocurrency at the equivalent price of $50.

The NFT project would create smart contracts for each purchase which states that once the creators of the NFT have received the specified amount, then the ownership of the digital asset, the NFT, will be transferred to the buyer.

Smart Contract Use Cases

Other than executing transactions for digital assets, what else can smart contracts be used for?

Decentralized Finance (DeFi) – Smart contracts are prevalent in DeFi. Whether it’s for lending, borrowing, or liquidity pools, contractual agreements can be very intricate. It’s always risky when money is involved, even with a neutral third party. When the smart contract’s terms are met, the smart contract executes.

Real Estate – In terms of real estate, a smart contract could help speed up processes such as property transfers, rental agreements, and fractional ownership.

Voting Systems – Voting can happen in the crypto world quite a lot. An example that comes to mind is Decentralized Autonomous Organizations or DAOs for short. It’s a community of members that do not have a central authority.

Instead, they rely heavily on voting power among its members to determine changes and actions within the community. Smart contracts help DAOs operate through voting mechanisms encoded within, to reach decentralized governance.

Digital Identification – Smart contracts can also be used to verify a person’s identity, certifications, and permissions. On the side of the individual, they can control what information is accessible by entities. Smart contracts offer more security and privacy on this front.

Insurance Processes and Settlements – There is a lot of room for negotiation and disagreement when it comes to insurance claims. An insurance company usually takes a long time to conduct insurance processes, and that’s where smart contracts can come in and speed them up. As for settlements, a smart contract is an excellent way to reduce fraud.

Supply Chain Management – We can see more examples of smart contract implementation in the future, but another major one is supply chain management. A smart contract can be used to track goods, verify authenticity, and more with automation.

With SecuX Wallets, users can safely store and manage the cryptocurrencies involved in these smart contract applications. The ability to securely handle digital assets and interact with smart contracts through a hardware wallet ensures that users’ investments are protected, adding another layer of trust and security. If you are interested in Solana dApps, you can find our update on SecuX Nifty's integration with Solana dApp WalletConnect.

Pros and Cons of Smart Contracts

There are plenty of benefits we can see from just the use cases above, but do these self-executing contracts bear any risks?

Advantages:

- Efficiency and accuracy by speeding up processes and eliminating human error in execution

- They are immutable

- They bring a layer of trust and transparency to a transaction

- A smart contract is secure

- They remove the need for an intermediary (which can save on costs)

Disadvantages:

- The smart contract’s code is permanent and cannot be altered (which makes it difficult to rectify errors)

- The security and coding rely on the programmer

Conclusion

A smart contract is more than just a computer program; it is an essential part of decentralization. These digital contracts enforce the coded terms without hesitancy or emotion and could be the pinnacle of contract execution, whether it involves digital money or global trade. SecuX's hardware wallets, including the new Neo Series, are designed to securely interact with these contracts, providing users with peace of mind as they navigate the growing world of blockchain technology.

Related Articles:

- Chat GPT Smart Contract Audit – Can It Do It?

- SecuX Nifty Unveils Groundbreaking WalletConnect Support for Solana Dapps

- DApp Connect – Adding More Value to Your Crypto Wallet

0 comments