Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice.

Cryptocurrency has taken the world by force in the last few years, with avid supporters on one side and skeptics on the other. Regardless of where you fall in the spectrum, there is no debate that diversifying your investment portfolio is a smart thing to do, even in traditional markets.

In the web3 world, a diversified crypto portfolio can potentially safeguard your investments better and possibly even open more doors to greater opportunities. Let’s look at how to diversify your crypto portfolio.

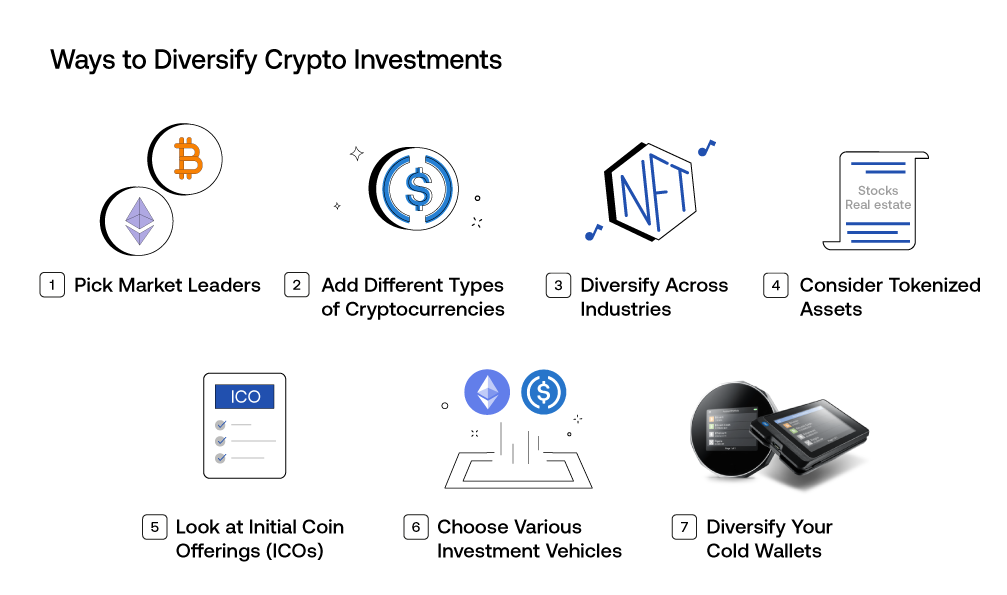

Ways to Diversify Crypto Investments

Exploring strategies to diversify your crypto investments is a crucial step in reducing risks and maximizing potential returns. From selecting market leaders to exploring tokenized assets, each section below offers valuable insights into effective diversification methods. Let’s begin!

Pick Market Leaders

A good place to start diversifying your crypto portfolio is to allocate a significant portion to established market leaders, like Bitcoin and Ethereum. These cryptocurrencies have stood the test of time so far and have widespread adoption, making them relatively safer investments compared to some altcoins.

While these two major players may offer lower short-term volatility, they can serve as stable anchors within your portfolio, balancing the overall risks.

Add Different Types of Cryptocurrencies

Invest in different types of crypto. Alongside major cryptocurrencies like the ones we named, consider exploring the world of altcoins. Yes, they are generally more volatile, but they can each offer unique features and use cases.

Stablecoins like USDC provide stability because they are pegged to stable assets, usually a fiat currency like USD. Privacy coins like Monero offer enhanced privacy, and utility tokens like Chainlink provide decentralized oracle services.

By incorporating various cryptocurrencies into your portfolio, you tap into different markets and capitalize on diverse opportunities. This approach helps crypto investors hedge against the risks of any single asset while maintaining exposure to the broader crypto ecosystem’s growth potential.

Diversify Across Industries

Crypto portfolio diversification can also be done across various industries within the blockchain space. Allocate portions of your portfolio to cryptocurrencies in with different sectors like decentralized finance (DeFi tokens), NFTs, supply chain (VeChain), and more. There are even ones that center on sustainability like Hedera’s HBAR.

Diversifying across industries reduces general risk and puts you in touch with multiple sectors positioned for growth. This can enhance your portfolio’s overall resilience to crypto market volatility.

Consider Tokenized Assets

Tokenized assets can be considered a bridge between traditional finance and the digital sphere. Basically, they are a digital representation of something in the real world. Tokenized stocks, real estate, and commodities are just a few examples of tokenized assets.

Investing in these tokens allows you to diversify your exposure to traditional markets while taking advantage of blockchain technology. Tokenized assets can add stability and diversification to your crypto portfolio.

Look at Initial Coin Offerings (ICOs)

Another good way to diversify your crypto holdings is to look into Initial Coin Offerings, or ICO for short. We’re not going to sugarcoat it, ICOs can be very volatile but also provide high rewards. This is why we only suggest allocating a small portion of your portfolio to more promising ICO projects.

These crypto projects usually have stronger fundamentals and innovative concepts. While ICOs are highly speculative and come with significant risk, they can yield substantial returns – if you choose well. You will need to conduct thorough research and due diligence and verify all of our information and sources to identify the best ICOs that will help you create a well-balanced crypto portfolio.

Choose Various Investment Vehicles

Diversify your crypto investments by using different ways of investing. Explore options like staking, yield farming, lending, or participating in liquidity pools. These methods can generate passive income and also diversify your crypto portfolio.

By spreading your investment method across various channels, you can increase your overall returns while managing risk more effectively. Depending on your risk tolerance and investment goals, you can allocate different portions of your portfolio to these vehicles, creating a well-balanced strategy that combines both active and passive income streams!

Diversify Your Cold Wallets

Security is the number one concern in the largely unregulated world of cryptocurrencies. Rather than storing all your crypto assets in a single cold wallet, consider spreading them across multiple hardware wallets. Each wallet can serve a specific purpose or hold different assets. Might we suggest the V20 for its ergonomic shape or the W20 for its large touchscreen?

This strategy ensures that a single security breach doesn’t jeopardize your entire crypto portfolio. It’s a practical step towards safeguarding your crypto holdings.

Assess and Rebalance Your Portfolio

Assessing and rebalancing your crypto portfolio is the key to maintaining a healthy financial position and optimizing returns. This process involves regularly reviewing your investments, their performance, and their alignment with your financial goals.

Assessing your crypto portfolio allows you to gauge its performance relative to your objectives. Are your investments meeting your financial goals, or do adjustments need to be made? By periodically evaluating your portfolio, you can identify assets that are underperforming, reduce potential risks, and capitalize on emerging opportunities.

Rebalancing is another imperative aspect of creating a balanced crypto portfolio. It involves using the information you get from assessing the crypto market to your advantage. It involves adjusting the allocation of your investments to maintain your desired risks and rewards. Over time, some assets may appreciate more rapidly than others and rebalancing helps you realign your investments with your risk tolerance and financial objectives. In a traditional market, rebalancing could be selling some stocks and buying more bonds if stocks have outperformed bonds.

How often should you do it? Well, that depends on your investment strategy and goals. Generally, it’s advisable to review your portfolio at least once a year. However, many things can impact financial circumstances, such as significant market fluctuations and this may warrant more frequent evaluations.

Conclusion

Diversifying your crypto portfolio is a strategic move that can safeguard your assets. By carefully choosing a mix of cryptocurrencies, industries, and investment methods, you can optimize your risk-reward profile and capitalize on the vast potential of the crypto market. Just remember that a well-diversified portfolio not only enhances your chances of success but also guards against the inherent volatility in web3 investments.

Related Articles:

Can You Earn Passive Income Through Crypto and NFTs?

Bitcoin’s Price – What Gives It Its Worth?

Crypto Market Capitalization – A Useful Valuation Metric?

Sources:

https://www.britannica.com/money/cryptocurrency-portfolio-diversification

https://www.honeybricks.com/learn/crypto-portfolio-diversification

0 comments