*Please note that the following article is for informational purposes only and should not be construed as financial advice.

There are risks in every type of investment, and impermanent loss is one that is quite prominent in the crypto world. More specifically, it impacts decentralized exchanges in decentralized finance (DeFi). What is it exactly and is there a way to protect your assets?

Let’s find out.

Table of Contents

- What is Impermanent Loss?

What is a Liquidity Pool?

We must first look at liquidity pools to understand impermanent loss. A liquidity pool is various liquidity providers pooling their assets together to create a pool of liquidity for a decentralized exchange (DEX). Having that liquidity pool allows these exchanges to execute transactions quickly.

DeFi liquidity pools offer a steady reserve to meet withdrawal demands quickly, but this would require users to have their assets locked up for a specified period via smart contracts.

The benefit of liquidity pools is that there is no need for an intermediary. Instead, users are connected automatically via an Automated Market Maker (AMM). Check out our article on liquidity pools to learn more about AMMs.

How to Become a Liquidity Provider

Impermanent loss is something that impacts the liquidity providers, the people who fund the liquidity pool with their assets. Liquidity providers can sometimes earn trading fees, passive income, and interest on their assets in the pool.

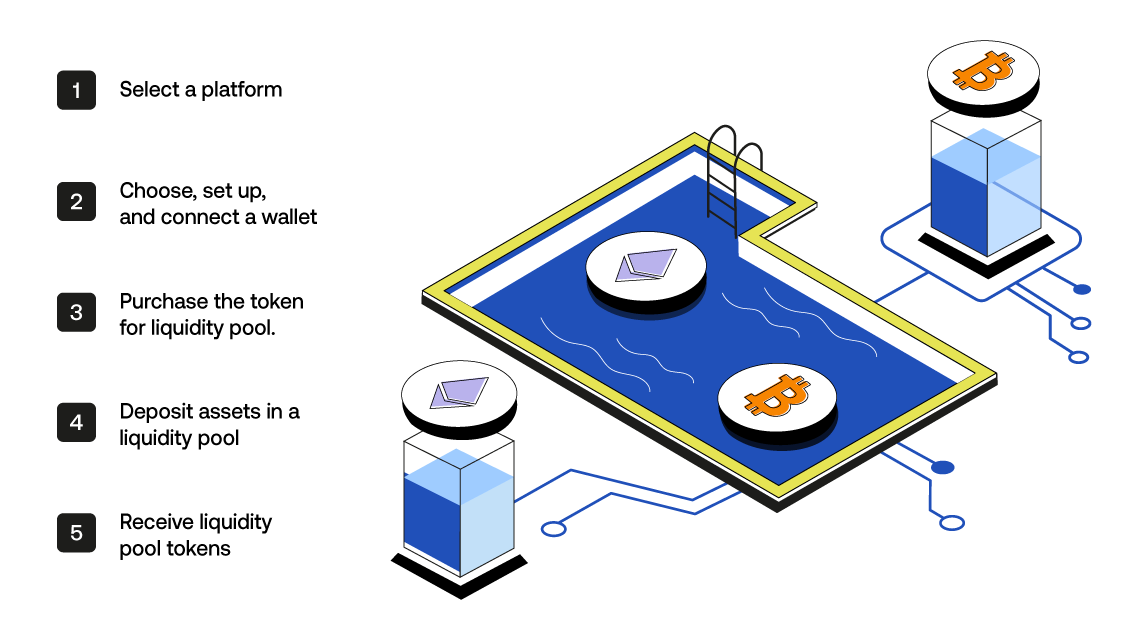

While the steps may vary a bit depending on the platform, the general instructions are:

- Select a platform – Look for a DeFi platform that provides liquidity pool services for your selected cryptocurrency pair. Uniswap is a good example of a DeFi.

- Choose, set up, and connect a wallet – SecuX provides lines of wallets that work with multiple tokens and platforms. Make sure to securely store your seed phrase.

- Purchase the token you want for the liquidity pool – You would need a token pair, and both would typically need to be of equivalent value. For example, if you have $1,000 to invest in ETH and USDC, you would need to purchase $500 of each. You can do this on a DEX that provides the pair of your choice.

- Deposit assets in a liquidity pool – The next step is to deposit your tokens into the pool. Start by connecting your wallet and follow the steps on the DeFi platform.

- Receive liquidity pool tokens – This part is important. In exchange for your deposit into the pool, you will receive tokens that represent your contribution to the pool. These tokens are also what you use to withdraw your liquidity at a future date.

Impermanent Loss Explained

It all looks simple enough, and it seems like providing liquidity has its fair share of benefits. One thing to remember is every investment, and providing liquidity is a type of investment, comes with risks. Impermanent loss is one such risk, and a prevalent one within the DeFi crypto world.

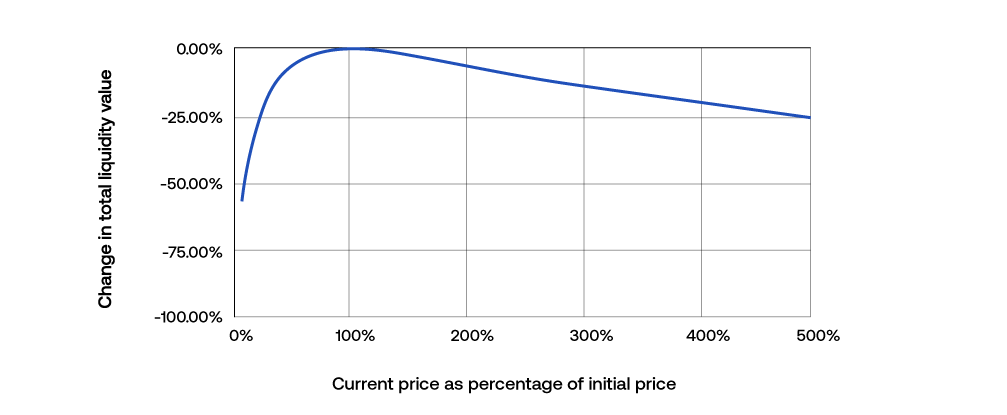

Impermanent loss occurs when liquidity providers lose some of their potential profits when the assets they placed within the pool lose value.

Impermanent loss is not the end of the world and is pretty common and usually temporary. Most investors can understand the potential of impermanent loss, especially if we look at the fluctuations that happen with regular stock investments.

Price Variation

Let’s dive a bit deeper.

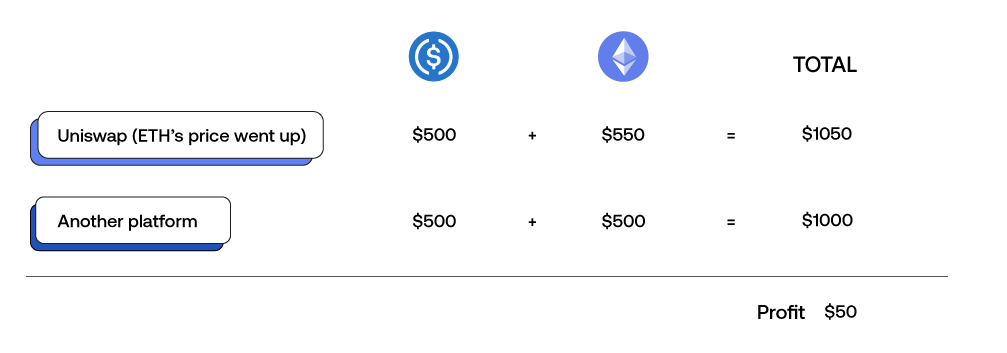

Let’s say a liquidity provider, or LP, provided an equal amount of liquidity for ETH and USDC in a Uniswap 50/50 pool. Let’s say the amount is $500 for each token for a total of $1,000 of liquidity. Price variation happens when the price of the assets in the pool changes in value. This can happen based on token supply and demand.

Arbitrage traders may take advantage of the price differences by comparing the price of the same asset in two different pools. Let’s say ETH’s price went up by $50 on Uniswap to become $550, while it remains $500 on another platform. Arbitrageurs can purchase low on a platform and sell high on Uniswap to make a profit.

This activity leads to increased trading volume and demand in the pool with the lower price, which makes the price in that pool increase. LPs who hold assets in that pool may experience losses because the value of their assets decreases due to the price increase. If the liquidity provider holds a substantial amount of assets in the pool being arbitrated, it could equal a significant amount of loss.

How to Reduce the Impact of Impermanent Loss

Just like with stock investments, there are steps people can take to minimize the potential of impermanent loss.

- Do your research and pick stable cryptocurrency pairs – Stablecoins such as USDC and USDT and prominent blockchain tokens such as ETH are your safest bets.

- Price correlation between token pairs – You want to pick token pairs with prices that seem to go in the same direction. This means when one of the token’s price goes up, the other one is positively impacted as well.

- Rebalance your liquidity – Watch your assets and monitor them closely. If you notice significant price changes and detect the potential for impermanent loss, you can rebalance your assets by adding or withdrawing from the pool.

- Diversify – Similar advice as regular stock investments, consider diversifying your portfolio. Instead of putting all your eggs into one liquidity pool, consider spreading your holdings across various exchanges and platforms.

- Insurance – There is such a thing as impermanent loss insurance, often referred to as Impermanent Loss Protection (ILP). It’s possible that a platform could offer this service that aims to compensate liquidity providers for potential losses, such as impermanent loss.

DeFi Protocol Safety Tips

Aside from trying to minimize impermanent loss, there are some safety tips that you should follow when conducting transactions on any DeFi platform.

- Do your research and look into the platform. Read reviews, ask around the community, and look at the team behind it and its security measures including smart contract security.

- Start by depositing small amounts. This can reduce the amount of potential losses.

- Beware of newer platforms. Not all new platforms are dangerous, but since they have just been established, there is a greater chance of security vulnerabilities due to a lack of testing.

- Choose a secure wallet. SecuX’s wallets are secured by Secure Element chips, which are one of the highest forms of security.

Conclusion

Unfortunately, impermanent loss is an inherent risk in DeFi. There are ways to mitigate and even avoid impermanent loss by choosing the right token pairs, monitoring and adjusting your deposits, and looking at ILP. If possible, diversify your investments across various platforms and be prepared for possible losses. After all, nothing is guaranteed, especially when we’re talking about financial investments and deposits.

Related Articles:

- Crypto Liquidity Pools – The What the Why the How

- What is Yield Farming in Crypto?

- The New and Improved WalletConnect 2.0

0 comments