Written by: Jess Lin

Contributor: Anderson Wu

Liquidity pools are an intriguing concept in the crypto DeFi (decentralized finance) world. The key is to not rely on centralized exchanges, maintaining what all crypto supporters hold important – decentralization. Crypto liquidity pools are essential for transactions revolving around trading. Finance lingo can be a little difficult for some, but we break down liquidity pools into simple terms.

Table of Contents

- Crypto Liquidity Pools – The What the Why the How

What are Liquidity Pools in DeFi?

Very much what it sounds like, a liquidity pool is users pooling their assets together to create a pool of liquidity for an exchange. It all takes place on a decentralized exchange (DEX) and having that liquidity pool allows these exchanges to execute transactions quickly.

From the side of the exchange, DeFi liquidity pools offer a steady reserve. The DEX utilizes the assets locked in the pool to complete transactions. As for users, they have to be ready to have their assets locked up for a specified period via smart contracts.

What’s interesting about liquidity pools is that there is no need for a middleman. Instead, users are connected automatically via something called Automated Market Makers (AMM) and transact with other users directly.

What is an Automated Market Maker (AMM)?

What are Automated Market Makers? The AMM is an automated algorithm that assesses the value of an asset based on the supply and demand within the pool. The said value of these assets is ever-changing and the AMM readjusts values depending on the impact the trade has on the pool as a whole. A great example of an AMM is Uniswap.

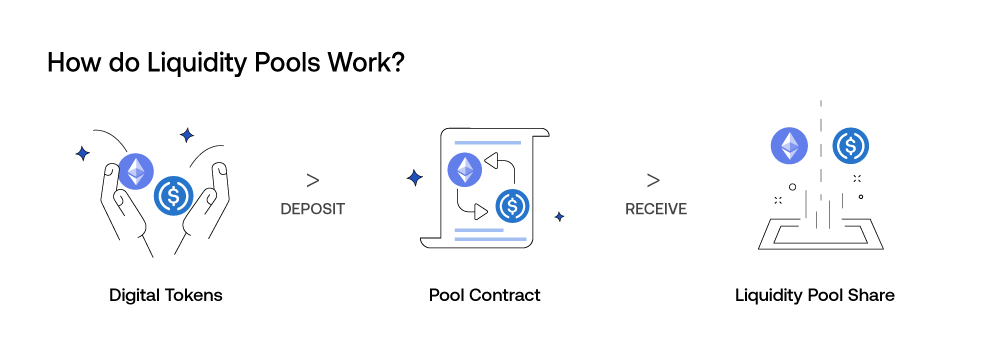

How do Liquidity Pools Work?

Crypto liquidity pools start with a crypto trader wanting to trade a certain pair of tokens. The AMM then connects the appropriate smart contracts to them. After the trade, the AMM readjusts the price of the asset traded.

Users can also aim to be liquidity providers, which just means they have contributed to the assets locked in a specific pool. To do this, users fund their crypto wallets like SecuX’s options with the digital token they will provide to the pool, connect the wallet to the platform and transfer the assets to the liquidity pool’s wallet.

The next step is to find the trading pair (cryptocurrency pairs) you want to invest in and deposit an equal amount of your crypto into both. For example, if you wish to lock up $100 in ETH and USDC, you would need to deposit $50 for both. Then determine the lockup period.

How are Liquidity Providers Incentivized?

Not only do you get your crypto assets back when the lockup period ends, but you also earn a portion of the trading fees, which is a percentage of the trade volume during the lockup period.

Some platforms also allow stacking on top of liquidity, which could also earn the providers native tokens from the platform.

Depending on the market, there is a chance that providers will earn passive income and it’s a nice way to diversify your holdings.

Why Do We Need Liquidity Pools?

After the quick breakdown, it all sounds pretty straightforward, but are liquidity pools necessary? What part do liquidity pools play in our daily lives? Do we really need them? The answer is yes.

For example, real estate is a great investment in certain areas around the world, but houses are illiquid. An illiquid asset is one that cannot be easily sold or exchanged for cash, or its value would depreciate greatly if it was.

Liquidity pools can be seen as the counter to illiquid markets and they support the DeFi system. Decentralization is highly prized in the crypto world, and a liquidity pool strengthens it. Users won’t need to rely on a centralized exchange.

We’ve also mentioned before that transactions are made easier and faster thanks to liquidity pools. They also enable users to enjoy lower fees thanks to the AMM. What’s really great about liquidity pools and liquidity providers is they spur ingenuity, innovation, and advancement within the crypto community.

Not to mention, they also give liquidity providers the chance to earn passive income and incentives.

Crypto Liquidity Pool Risks

As always, there are downsides to liquidity pools. Before participating in any sort of financial transaction, it’s important for everyone to understand the risks. In terms of liquidity pools, these risks include:

- Impermanent loss – there is a chance that the assets in the liquidity pool greatly decrease in value. It would be considered an impermanent loss when the asset you get back is lower than what it would have been if you hadn’t added it to the pool.

- Liquidity pool hacks – In typical online finance fashion, liquidity pools are also susceptible to hacks and scams. Before you trust a platform with your assets, make sure you do your due diligence.

- Low liquidity – Low liquidity leads to price slippage, which means there is a large difference between the expected price of a trade and what it actually is upon execution. This happens when the liquidity pool isn’t large enough.

Conclusion

There are risks to many transactions online, but as long as users are aware of the risks, and do proper research into a platform and the people behind it, then the rewards can greatly outweigh the threats. The concept of a liquidity pool is revolutionary within DeFi and it would be a great loss to not take advantage of the added benefits.

0 comments